Analyzing The $7.5B $ASI Crypto AI Merger

The crypto AI industry has been getting more attention in recent months, thanks to the growing prominence of AI solutions and the recent crypto market resurgence. A new proposed merger between three of the sector's major players has emerged, creating a $7.5B decentralized AI company that aims to take on AI juggernauts such as OpenAI, Microsoft, and Google, while marking a new phase in the progress of Web3 + AI.

Fetch.AI, SingularityNET, and Ocean Protocol have been rumored to merge into a according to reports from Bloomberg and major crypto news outlets on March 27. Later that day, the three projects confirmed the merger plans, with Fetch.AI outlining how the combination would "create the largest independent player in AI research and development."

The merger will form The Superintelligence Alliance, combining Fetch.ai's autonomous AI agents and blockchain infrastructure, SingularityNET's R&D in AI development and integration, and Ocean Protocol's data sharing and monetization. As part of this crypto AI alliance, the projects' $FET, $AGIX, and $OCEAN tokens will merge to form one universal AI token: the Artificial Superintelligence Token ($ASI). The alliance will also form a new governing council with representatives from the three crypto AI projects.

$ASI Merger Overview

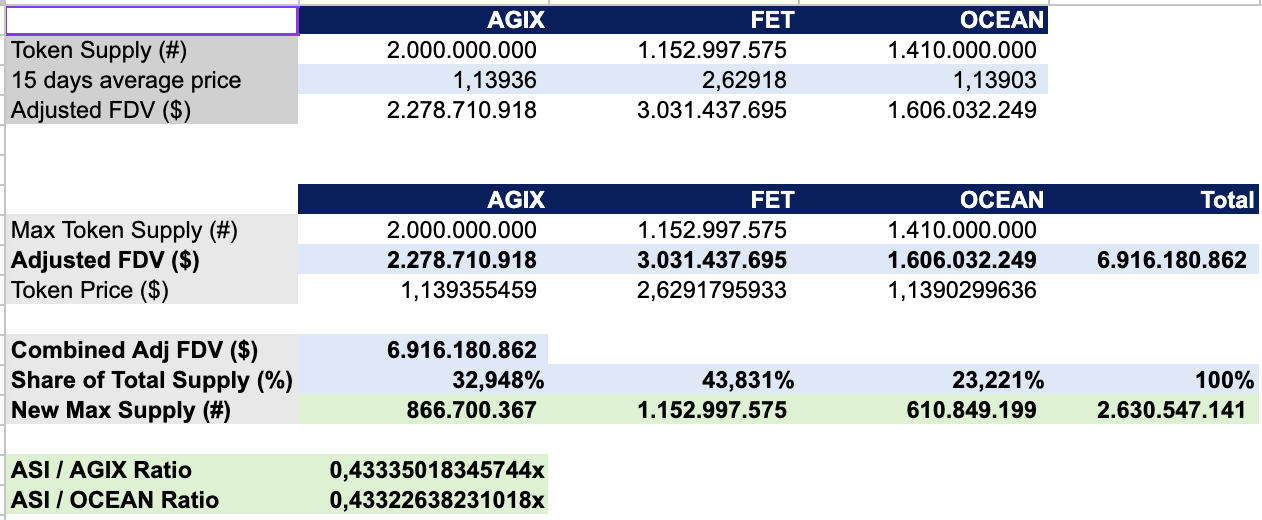

Under the terms of the merger, Fetch.AI's $FET was designated as the base token of The Superintelligence Alliance and will be renamed $ASI. The alliance will mint 1.48B tokens on top of the 1.15B existing token supply of $FET (soon-to-be $ASI), with 867M $ASI allocated to $AGIX holders and 611M $ASI allocated to $OCEAN holders.

This merger will set the total supply of $ASI tokens to 2.63B, with a fully diluted valuation of about $7.5B, based on benchmark token $FET's $2.82 price at the time of the announcement. Based on today's crypto market, $ASI would be the 22nd biggest crypto asset based on market cap, ahead of tokens such as $ARB, $LTC, $FIL, and $ATOM, among many major crypto brands.

This merger is subject to approval by the three crypto AI projects' communities starting April 2. This voting process will end on April 16

Arbitrage Opportunities

According to the token exchange mechanism for the launch of $ASI, $FET will effectively be swapped for $ASI tokens on a 1:1 basis. Ocean Protocol and SingularityNET token holders will receive 0.433226 $ASI per $OCEAN and 0.433350 $ASI per $AGIX, respectively. This exchange rate is fixed and will not change.

"We expect that smart arbitrageurs will notice if a price differential between the tokens arises, and then arb it out to maintain a balance and equilibrium in the exchange rate," according to Fetch.AI, which also shared this table illustrating the computations made for the tokenomics of the $ASI merger:

Given that the token swap ratio will not change, investors in $AGIX and $OCEAN can spot arbitrage opportunities for getting more $ASI depending on the prices of the two tokens.

If we use the 15-day average price, we see this computation for how much 1 $ASI will cost depending on the token you will use:

- 1 $FET = $1 ASI = $2.62918

- 1 $OCEAN = 0.433226 $ASI. Hence, $1.13903/0.433226 ≈ $2.629182 per $ASI

- 1 $AGIX = 0.433350 $ASI. Hence, $1.13936/0.433350 ≈ $2.62919118 per $ASI

Of course, prices fluctuate significantly in crypto. As of March 28 at around 10 AM UTC, here's the price computation:

- 1 $FET = $1 ASI = $3.35

- 1 $OCEAN = 0.433226 $ASI. Hence, $1.46863614/0.433226 ≈ $3.39 per $ASI

- 1 $AGIX = 0.433350 $ASI. Hence, $1.369386/0.433350 ≈ $3.16 per $ASI

If we take the prices as of March 29, 9 AM UTC, here's the computation:

- 1 $FET = $1 ASI = $3.27

- 1 $OCEAN = 0.433226 $ASI. Hence, $1.42/0.433226 ≈ $3.28 per $ASI

- 1 $AGIX = 0.433350 $ASI. Hence, $1.36/0.433350 ≈ $3.14 per $ASI

In all three scenarios, we see that $AGIX is constantly undervalued, while $OCEAN has a slight premium. Future price movements might change this situation, but these calculations can give you an idea of how to start looking into arbitrage opportunities ahead of potential merger approval. There are at least three more days from today until the start of community voting on the merger proposal on April 2.

How Markets and Whales Responded to the $ASI Merger

The formation of The Superintelligence Alliance triggered major jumps in the prices and trading volumes of $FET, $AGIX, and $OCEAN. However, those interested in making investment moves based on the merger should be cautious about potential risks.

Fortunately, one great way of getting comprehensive token reports and analysis on the tokens of interest in this merger is by using an AI crypto trading tool like Scopechat. According to AI analysis and Scopescan data, here are the bullish indicators for the three tokens involved in the merger:

- Tokens under the crypto AI narrative went up by 20.8% in the past 7 days. $FET and $AGIX outperformed the sector with growth rates of 27.5% and 25.71%, respectively, while $OCEAN lagged a bit with a 19.89% rise.

- All three tokens are currently being traded long in CEX perpetual markets, with the funding rates for $AGIX, FET, and $OCEAN set at 0.07%, 0.06%, and 0.05%, respectively.

- Whale holders of $OCEAN have grown their holdings by $33.3M, or 12.63%, with most of the increase coming from the 59 large whales holding 12.11% of the token's supply. Meanwhile, $FET's whale holders increased their holdings by 8.51%, acquiring 37.3M FET tokens valued at $121.2M.

Meanwhile, here are areas of concern regarding the three tokens:

- Over the last week, venture capital firms (VCs) decreased their total $OCEAN holdings by $5.7M (-40.84%) over the past 7 days to $8.3M changed by -40.84% over the last 7 days. The VC that decreased their holdings the most was GSR, which unloaded about 4.1M $OCEAN tokens.

- To add to the previous point, GSR deposited a total of 3.9M $OCEAN tokens, worth a combined $5.2M, on Binance in three separate transactions from March 26-28.

- Speaking of exchanges, there was a net inflow of $39.5M in $AGIX tokens on these platforms over the past week. Investors may be relatively bearish on the token, opting to deposit and potentially sell it on exchanges.

- One of the major $AGIX depositors to exchanges is the SingularityNET treasury itself, which transferred 2M $AGIX ($2.52M) to Gate.io's deposit address.

- The current token prices for the three tokens are above their upper Bollinger Bands, suggesting a potentially overbought market. The tokens' prices may be relatively high, and a short-term reversal or pullback might occur.

Conclusion

The formation of The Superintelligence Alliance and the upcoming merger of $FET, $AGIX, and $OCEAN tokens into $ASI will likely result in access to greater economies of scale for the decentralized AI sector. This is likely the biggest crypto token merger we've seen so far, and it's happening in the flourishing crypto AI space. But while the upside is great for the alliance and the greater Web3 AI sector, participants should be careful of market moves and other factors that may pose challenges to this new company's growth, especially given the recent transactions of some of the projects' major backers

Visit 0xScope

0xScope | Scopescan | Link3 | X | Telegram | Youtube | Discord